Now that we are reaching the end of the tax year, it’s an excellent time to review your finances. We’ve listed below some of the critical areas to consider and provide you with useful guidelines.

We have divided our tax planning tips into five sections:

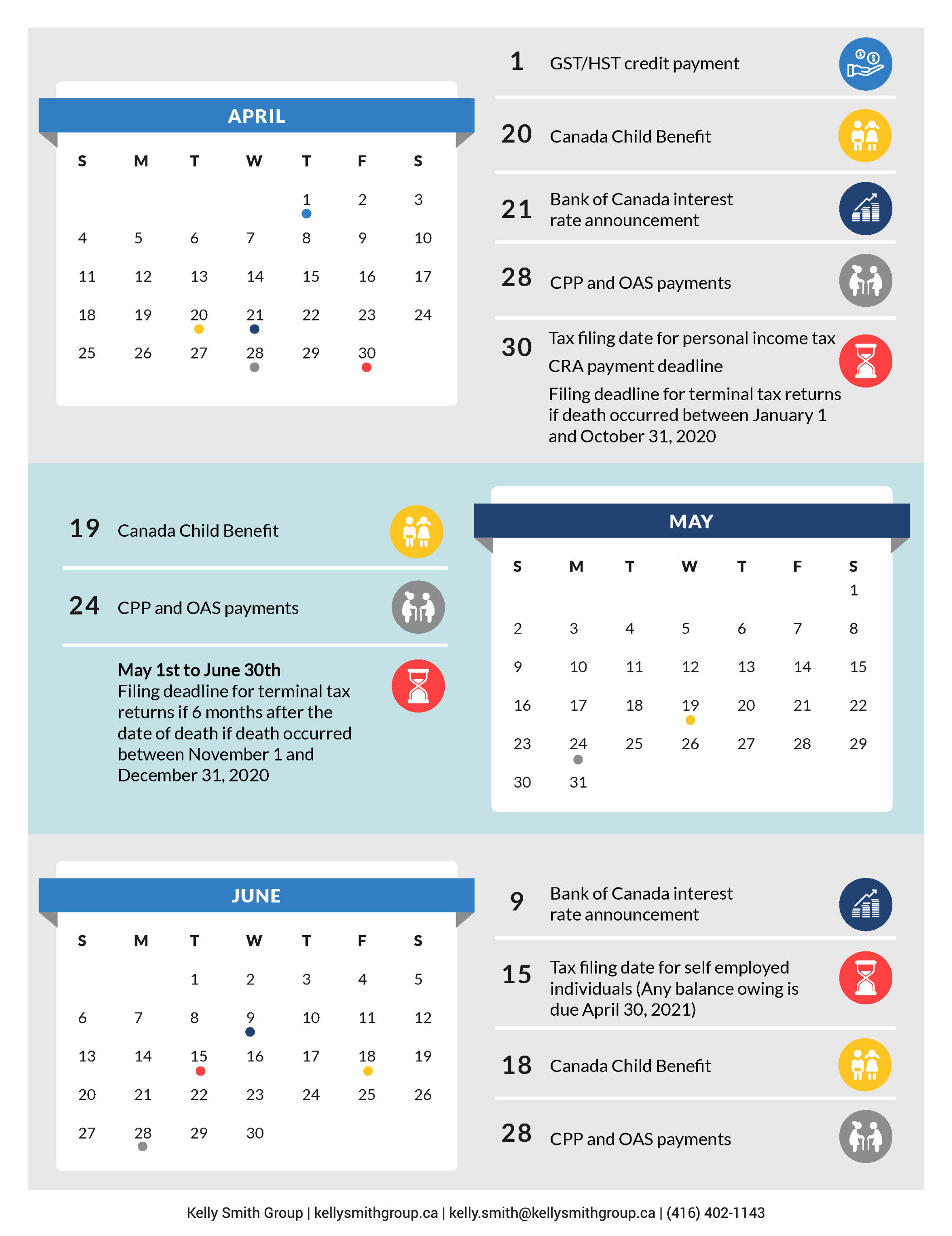

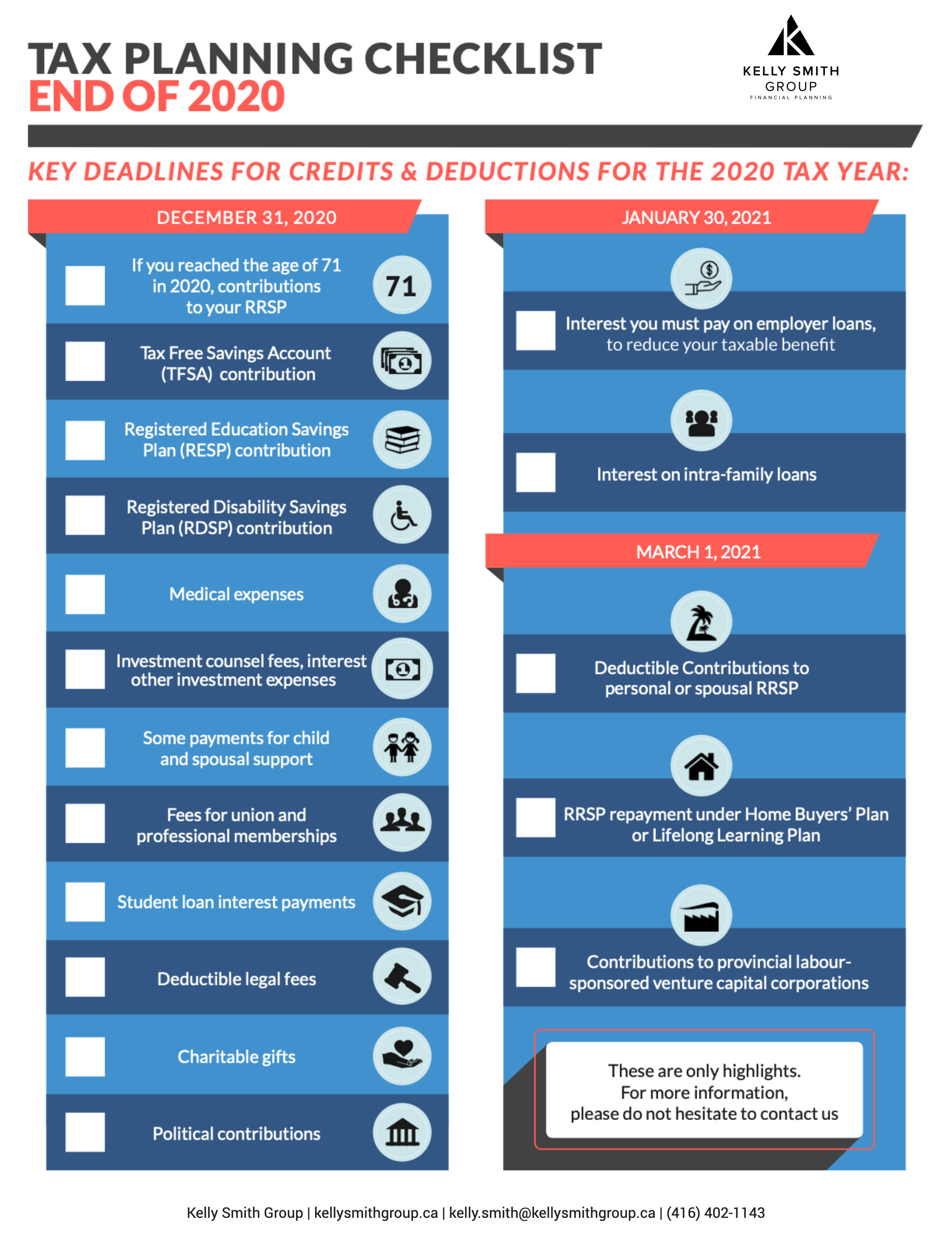

Tax Deadlines for 2020 Savings

December 31, 2020:

-

If you reached the age of 71 in 2020, you can’t contribute to your RRSP after this date

-

Use up your TFSA contribution room

-

Contribute to an RESP to get the Canadian Education Savings Grant (CESG) and the income-tested Canada Learning Bond (if eligible).

-

Contribute to an RDSP to get the Canada Disability Savings Grant (CDSG) and the income-tested Canada Disability Savings Bond (if eligible).

-

Medical expenses

-

Investment counsel fees, interest and other expenses relating to investments

-

Some payments for child and spousal support

-

Fees for union and professional memberships

-

Student loan interest payments

-

Deductible legal fees

-

Charitable gifts

-

Political contributions

January 30, 2021

March 1, 2021

-

Contributions to provincial labour-sponsored venture capital corporations

-

RRSP Repayment under Home Buyers Plan or Lifelong Learning Plan

-

Deductible contributions to a personal or spousal RRSP

Individual Tax Issues

To help Canadians deal with financial hardships due to job loss because of COVID-19, the Canadian government introduced several benefit programs. If you received any of these benefits, you should be aware of the tax ramifications.

The Canada Emergency Response Benefit (CERB) was the first benefit program issued by the government and ran until September 26, 2020. If you received the CERB at all during 2020, the government will issue you at T4A, showing how much money you received from the CERB program. You must then declare that as income when filing your 2020 income tax return. Since no tax was taken off at the source, be sure to put aside money to pay for potential income taxes on your CERB income.

As of September 27, 2020, the government offered three replacement benefit programs:

-

Canada Recovery Benefit (CRB)

This is for people impacted by COVID-19 who work but are not eligible for EI (e.g. self-employed).

-

Canada Recovery Sickness Benefit (CRSB)

This is for people who are employed cannot work due to COVID-19 and do not have access to paid sick leave.

-

Canada Recovery Caregiving Benefit (CRCB)

This is for people who must miss work to care for a family member who has COVID-19.

For all three of these programs, the government will be withholding 10% in taxes upfront, but you may end up owing extra tax, depending on the rest of your income for 2020, so it’s important to set extra money aside for taxes.

Also, there is a unique condition for the CRB only. If you make over $38,000 in 2020 (excluding the CRB), you will have to pay back the CRB at a rate of 50 cents for each dollar of CRB you earned above the threshold.

If you paid interest on an eligible student loan in 2020, you can claim a non-refundable tax credit in the amount of interest you paid by December 31. In addition, you should be aware that student loan payments were frozen for six months – from March 30 to September 30. No interest accrued on student loans during that period.

Family Tax Issues

-

Check your eligibility for the Canada Child Benefit

(CCB)

To receive the Canada Child Benefit in 2021/22, you need to file your tax returns for 2020 as the benefit is calculated using your family income from the previous year. Eligibility for the CCB depends on set criteria such as your family’s income, how many children you have, and how old they are. You may qualify for a full or partial amount, depending on whether you have full custody or shared custody.

-

Consider family income splitting

The CRA offers a prescribed low-interest rate on family loans. Therefore, it makes sense to consider setting up an income splitting loan arrangement with your family members. If you do this, you can potentially lock in a family loan at a low-interest rate of 1% and then invest the borrowed money into a higher return investment while benefitting from your family member’s lower tax status. Don’t forget to adhere to the Tax on Split Income rules.

Managing Your Investments

-

Use up your TFSA contribution room

If you can, it’s worth contributing the full $6,000 to your TFSA for 2020. You can also contribute more (up to $69,500) if you are 29 or older and haven’t made any previous TFSA contributions.

-

Contribute to a Registered Education Savings Plan (RESP)

The Registered Education Savings Plan (RESP) is a savings plan for parents and others to save for a child’s education. The Canada Education Savings Grant (CESG) will match up to 20% of your contributions up to a maximum of $2,500.

That means the CESG can add a maximum of $500 to an RESP each year. The grant room accumulates until your child turns 17. Therefore, any unused CESG amounts for the current year are automatically carried forward for possible use in the future years.

The income-tested Canada Learning Bond (CLB) is paid directly to a child’s RESP by the Canadian government to low-income families. No personal contributions are required to receive the CLB.

-

Contribute to a Registered Disability Savings Plan (RDSP)

The Registered Disability Savings Plan (RDSP) is a savings plan for parents and others to save for the financial security of a person who is eligible for the Disability Tax Credit (DTC). The government will pay a matching Canada Disability Savings Grant (CDSG) up to 300% – depending on the beneficiary’s adjusted family net income and amount contributed.

Also, low-income Canadians with disabilities may be eligible for a Canada Disability Savings Bond (CDSB). If you qualify, it will be paid directly to your RDSP.

The government will pay matching grants or bonds into the RSDP up to and including the end of the year the recipient turns 49. Be aware that there is a 10-year carry-forward of CDSG and CDSB entitlements.

-

Donate securities to charity

Donating by year-end will provide you with tax savings. If you donate eligible securities or mutual funds, capital gains tax does not apply, and you can receive a tax receipt for their full market value. Also, the charity gets the full value of the securities.

-

Think about selling any investments with unrealized capital losses

It might be worth doing this before year-end to apply the loss against any net capital gains achieved during the last three years. The last trading date for 2020 for Canadian and US publicly traded stocks will be Tuesday December 29th in order to record the gain or loss in the 2020 taxation year.

Conversely, if you have investments with unrealized capital gains that cannot be offset with capital losses, it may be worth selling them after 2020 to be taxed on the income the following year.

-

Consider the timing of purchasing of certain non-registered investments

Suppose you are considering purchasing an interest-bearing investment like a guaranteed investment certificate (GIC) with a maturity date of one year or more. In that case, you may consider delaying the purchase to the following year, so you don’t have to pay tax on accrued interest until 2021. You should also consider this with mutual funds that make taxable distributions before the end of 2020, consider delaying this until early 2021. Don’t pay taxes earlier than necessary.

-

Check if you have investments in a corporation

The new passive investment income rules apply to tax years from 2018 onwards. They state that the small business deduction is reduced for companies with between $50,000 and $150,000 of investment income. Therefore, the small business deduction has entirely stopped for corporations that earn a passive investment income of more than $150,000.

Note – At a provincial level, both Ontario and New Brunswick do not follow the federal rules to limit access to the small business deduction.

Retirement Planning

-

Make the most of your RRSP

The deadline for making contributions to your RRSP for the year 2020 is March 1, 2021. The deduction limit for 2020 is limited to 18% of the income you earned in 2020, to a maximum of $27,230. This maximum amount is impacted by the following:

-

Any pension adjustment

-

Any previous unused RRSP contribution room

-

Any pension adjustment reversal.

Remember that deducting your RRSP contribution reduces your after-tax cost of making said contribution.

-

Check when your RRSP is due to end

If you reach the age of 71 during 2020, you must wind up your RRSP this year. You must make your final contribution to it by December 31, 2020.

-

Convert to RRIF before year-end

If you turned 65 during 2020 or are already older than 65, you’re entitled to a pension credit that can fully or partly offset the tax on the first $2,000 of eligible income annually. Consider setting up an RRIF before year-end to pay out $2,000 annually if you don’t have any other eligible pension income.

If you have any questions about your taxes for 2020, contact us – we can help you!